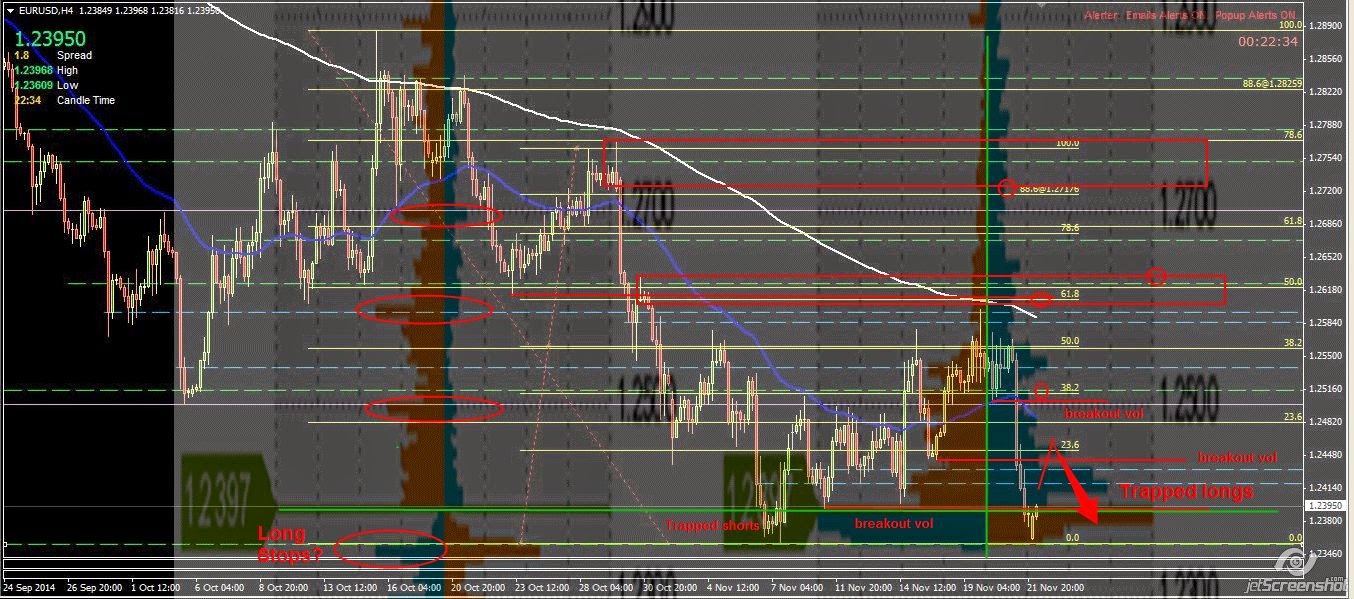

EU Analysis:

EU: Week- The candle is a normal spread (224pips) bear spinning top closing near the low on high vol<3weeks. The candle close and volume suggests more downside. Daily- The candle is a large spread (192pips) bear closing near the low on high vol>6days. The candle close and volume suggests more downside. Levels of interest: Demand: Daily/Weekly: 1.2266, 1.2240, 1.2157, 1.2182, 1.2133, 1.2105, 1.2053, 1.2037 Supply: short-term: 1.2442, 1.2470, 1.2490, 1.2515, 1.2545, 1.2565, 1.2600, 1.2632, 1.2640, 1.2685, 1.2745 (confluence with Monthly ema200 1.2735) Order Book Stops: There are no clear significant stop order levels for shorts as many of the fortunate retail crowds benefited from Draghi's speech and either closed out their positions or took profits. Stacks of sell orders, possibly a combination of weak longs and late comers trying to enter the trade can be see at 1.2400 - 1.2500, 1.2600, 1.2700 Background: The Euro remains weak based on fundamentals. Last Friday, I wrote "SM is likely to test the 1.2600 level and higher before resuming the downtrend" but ECB Draghi's extremely dovish speech on Friday sent the Euro into a tailspin against just about every other currency and may just be the catalyst for resumption of the downtrend. Prices opened gapped down by about 26pips as SM removed weak longs before reversing back upward to fade weak shorts. After a huge move and after profit taking, with no significant orders located within easy striking distance above, SM will likely fade the weak shorts to around the breakout levels and then reverse downwards to resume the downtrend.

EU long levels: 1.2500, 1.2477, 1.2465, 1.2457, 1.2442

GU Analysis:

GU long levels: 1.5630-15, 1.5591, 1.5561

GU short levels: 1.5734, 1.5816, 1.5825, 1.5840, 1.5880, 1.5905

Posted at 3.49 am EST

No comments:

Post a Comment