I wish all our friends HAPPY THANKSGIVING and may God bless you exceedingly and abundantly!

EU Analysis:

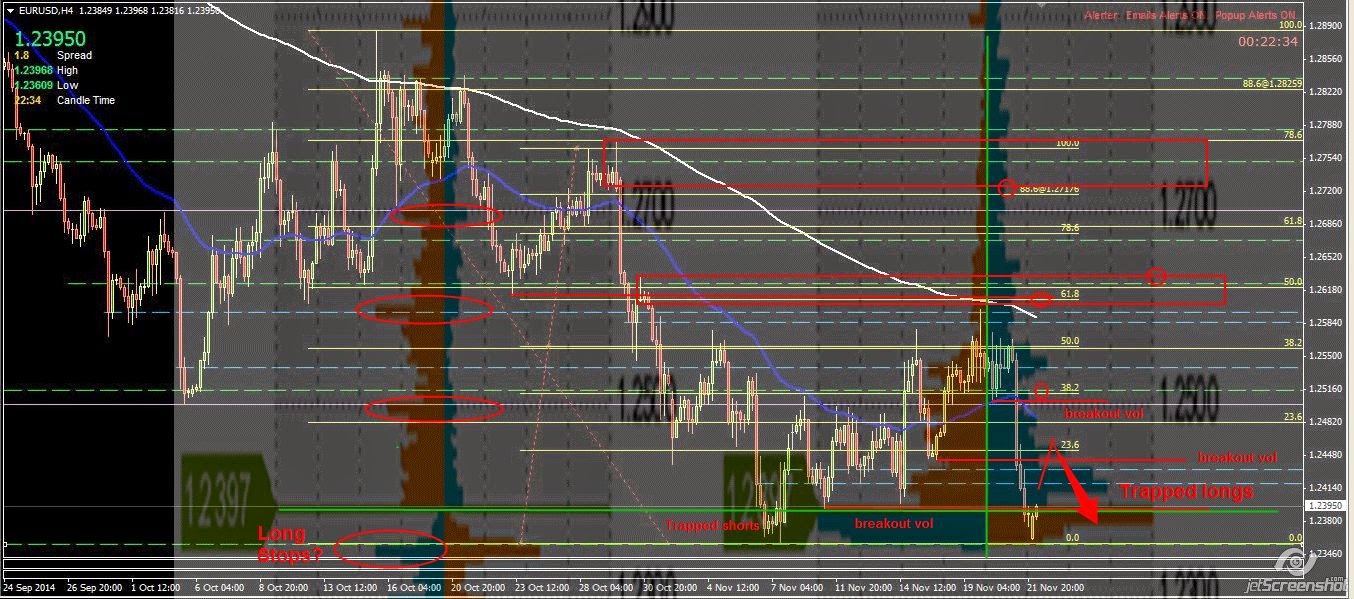

EU: Daily- The candle is a normal spread (88pips) bull spinning top closing on low vol<1day. The candle close and volume suggests more upside. Levels of interest: Demand: Daily/Weekly: 1.2266, 1.2240, 1.2157, 1.2182, 1.2133, 1.2105, 1.2053, 1.2037 Supply: short-term: 1.2600, 1.2640, 1.2685, 1.2745 (confluence with Monthly ema200 1.2735) Background: Euro's fundamentals remain weak and after ECB's Draghi sent the Euro into a tailspin, the market is now waiting on the European CPI and employment data on Friday to close out the last working day of the month. The order stacks at 1.2525, 1.2550, 1.2565, 1.2577, 1.2600, 1.2700 for the eventual push downwards are still in place. Prices reached a high of 1.2531 yesterday for restocking by SM and has since seemingly plunged below the 1.2500 level prior to the release of the German employment data in 10mins time and further data and speech by Draghi laster at 5.30am EST. SM is likely to fade the weak longs to around the 1.2470 or lower before reversing to commence the restocking of shorts.

EU long levels: 1.2470, 1.2437, 1.2423, 1.2413, 1.2400

GU Analysis:

GU: Day- The candle is a large spread (126pips) bull closing at the high on low vol<1day. The candle close and volume suggests more upside. Demand: Weekly/Daily: 1.5426, 1.5100 Supply: Short term: 1.5816, 1.5825 Background: No change on the fundamentals. BOE's Carney expects the UK recovery to continue but remains an economy that needs stimulus. There is no significant demand level until 1.5500 - 1.4426 pivot. SM pushed prices to 1.5805 and went to 1.5824 in Asia before stalling and reversing. Note that the order book does not show any significant bunch of volume trapped either long or short so it is best to wait for setups back at structures or the current highs. SM is likely to maintain the selling pressure to fade the weak longs to he breakout level 1.5735 or lower before reversing to continue the upward restocking of shorts.

GU long levels: 1.5734, 1.5720, 1.5702, 1.5670, 1.5650, 1.5630-15, 1.5591, 1.5561

GU short levels: 1.5825, 1.5840, 1.5880, 1.5905

Posted at 4.05 am EST