DAILY REVIEW 14 September 2016

EU Analysis:

EU: Perspective: Price has tested and broken through the 1.0500 which is simply a monthly low and psychological level with the next pyscholoabout 1/3 off the gical level at 1.0000 and the 0.9900 level being the breakout retest of a reaccumulation structure. December's candle suggests a retracement is in progress and January's candle is an "inside" of the December candle while February's candle also closed back inside the January range. We also note that there are no significant orders/ stops lower until the 1.0000 key level. Bias is still strongly down from a market structure perspective.

MONTH- The candle is a below average spread (320pips) doji closing on low vol<23months. The candle close and volume suggests no selling pressure.

WEEK- The candle is an average spread (187pips) bull closing about 1/2 off the high on low vol>5weeks. The candle close and volume suggests selling absorption.

DAY- The candle is a below average spread (64pips) bull closing 1/3 off the high on low vol<4days. The candle close and volume suggests no selling interest.

Levels of interest: Demand: Daily/Weekly: 1.0000

Background: The possible FED rate hike continues to weigh despite mixed US data. The current risk aversion climate in view of the continuing security situation in Europe is expected to continue and any rate hike, if any, is likely to be minimal. In any case, it will likely be limited to one more for the year in light of the forthcoming US Presidential Election and uncertainty for the world economy post-Brexit. In this situation, raising rates may be counter-productive and this is what the FED will need to contend with.

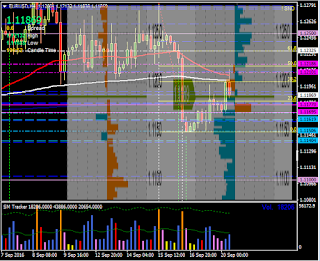

Oanda order book: Volumes are thin but with more trapped short positions with newly profitable shorts from around 1.1246.

Prices spiked to 1.1275 before fading yesterday. The Euro CPI and US Core Retail Sales will give SM license to whiplash prices and then move in the intended direction. SM possible scenario is to continue fading weak longs and induce new shorts at 1.1200 key level or lower, reverse long to test 1.1320 and higher.

EU long levels: 1.1200, 1.1150-1.1140, 1.1120, 1.1118, 1.1108, 1.1100, 1.1045, 1.0950, 1.0938, 1.0911

EU short levels: 1.1235, 1.1290-1.1300, 1.1325, 1.1350, 1.1365-1.1371, 1.1422, 1.1452, 1.1496-1.1500, 1.1518-1.1528, 1.1592, 1.1600, 1.1615-1.1620, 1.1711

GU Analysis:

GU: Perspective: GU has closed below April pivot 1.4564. The June close of 1.5701 becomes important as a supply level to overcome for higher prices. The downward bias is still dominant. Brexit has already seen the United Kingdom's British Pound drop significantly. The key word here is "United" because of possible secession by the pro-EU countries, if both Scotland and Northern Ireland leave there will not be much of a United Kingdom and the ramifications that such secession will birth. The British Pound as we know it would then lose significant backing economic capital (land, people, resources, etc) and thus lose its value which is not inconceivable.

MONTH- The candle is a below average spread (506pips) bear closing about 1/2 off the low on low vol<6months. The candle close and volume suggest no selling pressure.

WEEK- The candle is a below average spread (205pips) bear upthrust closing on low vol>5weeks. The candle close and volume suggests more downside.

DAY- The candle is a normal spread (101pips) bull closing 1/2 off the low on high vol<2days. The candle close and volume suggests initial buying.

Demand: Weekly/Daily: not applicable after 31 year low was broken through. Supply: Short term: 1.5574, 1.5600, 1.5619

The Oanda order book: Volumes are thin with both trapped shorts and longs.Newly profital shorts from 1.3252 level.

Trading GU now is not for the fainthearted. I still don't suggest longs on GU because of extreme volatility and continue to look for short positions. The interest rate decision and MPC Minutes will be released later. SM is likely to whipsaw. It is difficult to call the direction so I'll just watch these levels below.

GU long levels: 1.3150 - 1.3140 (possible trap level)

GU short levels: 1.3280, 1.3350, 1.3375, 1.3445, 1.3485-1.3495, 1.3523-1.3533, 1.3655, 1.3695, 1.3711, 1.3779, 1.3815, 1.3837, 1.3874, 1.3928, 1.3974, 1.4569, 1.4685, 1.4830, 1.4925, 1.4977, 1.5000

Posted at 3.27 am EST