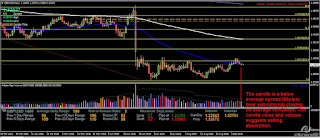

EU Analysis:

MONTH- The candle is a below average spread (320pips) doji closing on low vol<23months. The candle close and volume suggests no selling pressure.

WEEK- The candle is an average spread (187pips) bull closing about 1/2 off the high on low vol>5weeks. The candle close and volume suggests selling absorption.

DAY- The candle is an above average spread (86pips) bear spinning top closing on high vol<1day. The candle close and volume suggests more downside with selling absorption.

Background: The possible FED rate hike continues to weigh despite mixed US data. The current risk aversion climate in view of the continuing security situation in Europe is expected to continue and any rate hike, if any, is likely to be minimal. In any case, it will likely be limited to one more for the year in light of the forthcoming US Presidential Election and uncertainty for the world economy post-Brexit. In this situation, raising rates may be counter-productive and this is what the FED will need to contend with.

Oanda order book: Volumes are thin but with clear trapped short positions.

Without major news today, SM is likely to continue fading weak shorts to Friday's high 1.1285 or higher before reversing.

EU short levels: 1.1290-1.1300, 1.1325, 1.1350, 1.1365-1.1371, 1.1422, 1.1452, 1.1496-1.1500, 1.1518-1.1528, 1.1592, 1.1600, 1.1615-1.1620, 1.1711Without major news today, SM is likely to continue fading weak shorts to Friday's high 1.1285 or higher before reversing.

EU long levels: 1.1200, 1.1150-1.1140, 1.1120, 1.1118, 1.1108, 1.1100, 1.1045, 1.0950, 1.0938, 1.0911

GU Analysis:

MONTH- The candle is a below average spread (506pips) bear closing about 1/2 off the low on low vol<6months. The candle close and volume suggest no selling pressure.

WEEK- The candle is a below average spread (205pips) bear upthrust closing on low vol>5weeks. The candle close and volume suggests more downside.

DAY- The candle is a below average spread (96pips) bear spinning top closing on average vol<2days. The candle close and volume suggests selling absorption.

DAY- The candle is a below average spread (96pips) bear spinning top closing on average vol<2days. The candle close and volume suggests selling absorption.

Demand: Weekly/Daily: not applicable after 31 year low was broken through. Supply: Short term: 1.5574, 1.5600, 1.5619

The Oanda order book: Volumes are thin with more trapped shorts and the majority of the newly profitable shorts from the 1.3300 level.

Trading GU now is not for the fainthearted. I still don't suggest longs on GU because of extreme volatility and continue to look for short positions. Without major UK data today, SM is likely to fade weak shorts to 1.3300 key level or higher before reversing.

Trading GU now is not for the fainthearted. I still don't suggest longs on GU because of extreme volatility and continue to look for short positions. Without major UK data today, SM is likely to fade weak shorts to 1.3300 key level or higher before reversing.

GU long levels: not applicable

Posted at 12.53 am EST

No comments:

Post a Comment