EU Analysis:

EU: Monthly- The candle is a large spread bear closing just off the low on average vol>7months. The candle close and volume suggests more downside. Daily- The candle is a large spread (131pips) bear closing 1/2 off the low on high vol>6days. The candle close and volume suggests buying but with more downside. Levels of interest: Demand: short-term 1.2570 Daily/Weekly: 1.2034 Supply: short-term: 1.2634, 1.2653, 1.2661, 1.2690, 1.2740 (monthly ema200). Background: The German rates and yields being held negative out to 4 years changed the fundamentals and caused the Euro to weaken against just about every currency and EU responded by breaking the 1.2661 pivot to create a fresh low of 1.2570. The bias is most certainly to the downside now with the change of fundamentals. SM retraced upwards from 1.2570 yesterday fading weak shorts and is likely to continue fading weak shorts to the current swing high 1.2634 or higher before reversing to continue the downward movement.

EU long levels: 1.2570, 1.2034

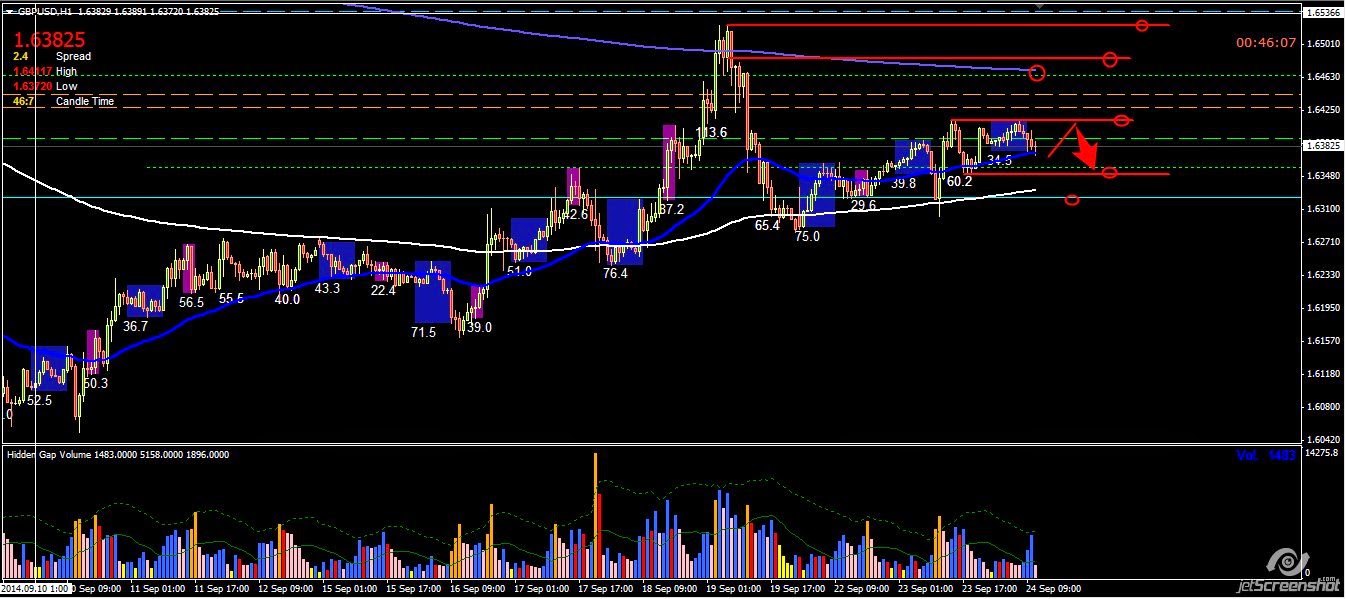

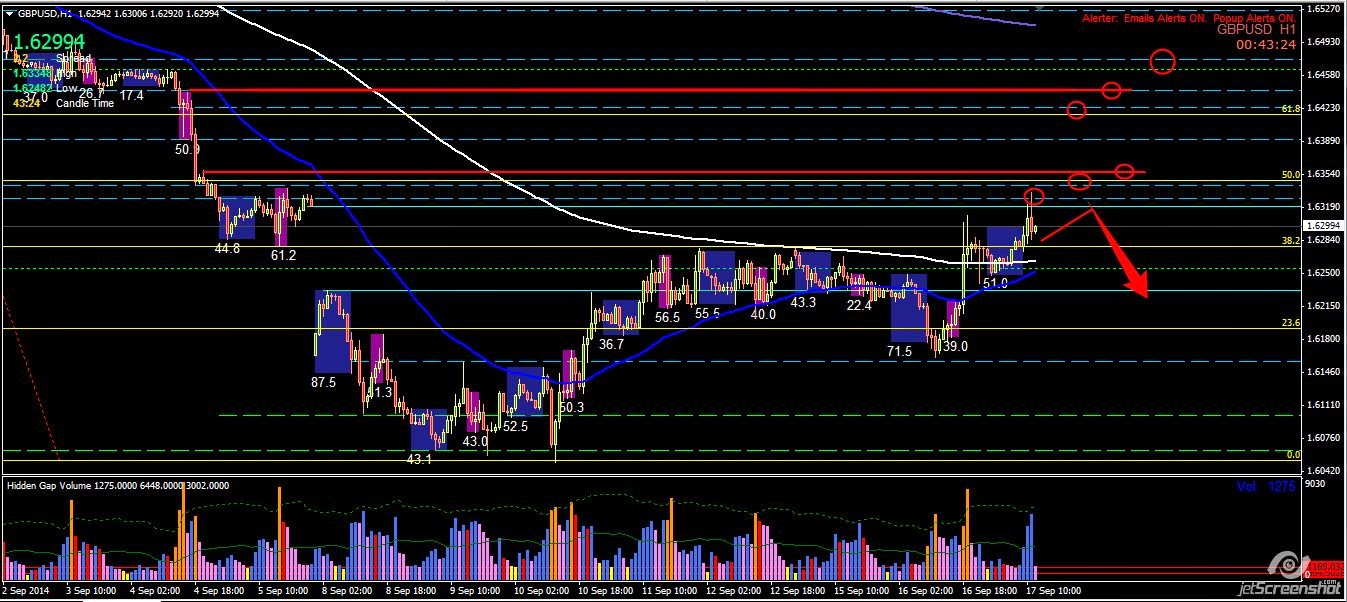

GU Analysis

GU long levels: 1.6161, 1.6050, 1.5870

GU short levels: 1.6523, 1.6585, 1.6600, 1.6622

Posted at 02.41 am EST