EU Analysis:

EU long levels: 1.2777, 1.2754, 1.2661

EU short levels: 1.3025, 1.3050

GU Analysis

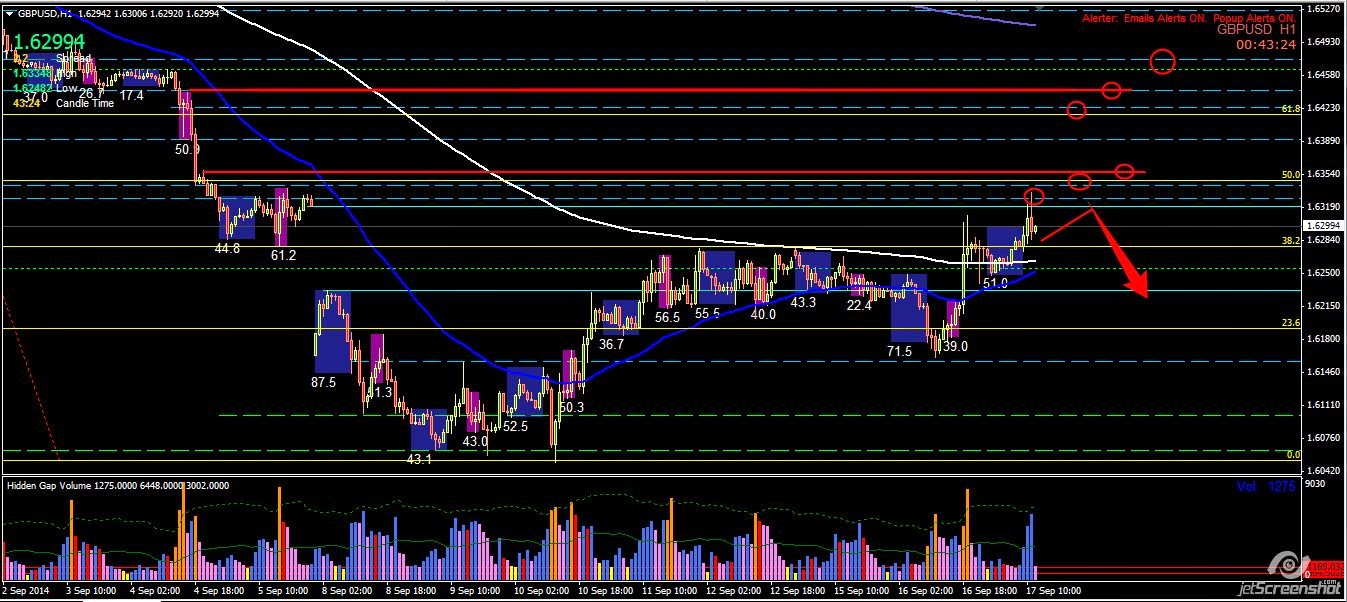

Background: The Scottish referendum is TOMORROW. The very large moves on insignificant news are usually what SM does re-positioning prices and orders according to their expectations. As expected, the retail traders chasing the shorts got trapped and are in severe drawdown if not already dead and buried. I did write that the cable will likely whipsaw as we approach the day of reckoning and it's exactly what happened and will likely continue until the vote itself. Price has already gone past the gap close level of 1.6320 with the current day high at 1.6335. A look at the order book (retail positions) reveal no open orders roughly from 1.6400 - 1.6420, with a massing of sell orders from current price to around 1.6400 Whatever the outcome of the referendum, the USD strength will remain whilst the Ukraine and ISIS situations remain unresolved and this would mean a reload of short positions for SM. The positive UK data today notwithstanding, where price spiked and is now retracing, is likely the reload for SM to take prices up again before reversing. The news say that the likely outcome is too close to call so anything that is not at a significant level will not be worth trading and holding. Having said that, SM is likely to fade weak longs to around the Asia low 1.6248 before reversing to retest the current day high at 1.6335 or higher (see the chart for levels) before reversing to resume the downtrend. In the event that price closes above 1.6360, we can expect it to test the 1.6400 key level.

GU long levels: 1.6248, 1.6050, 1.5870

GU short levels: 1.6335, 1.6340, 1.6358

Posted at 06.00 am

No comments:

Post a Comment