EU Analysis:

EU long levels: 1.2777, 1.2754, 1.2661

EU short levels: 1.2900, 1.2925, 1.2952, 1.3000, 1.3025, 1.3050

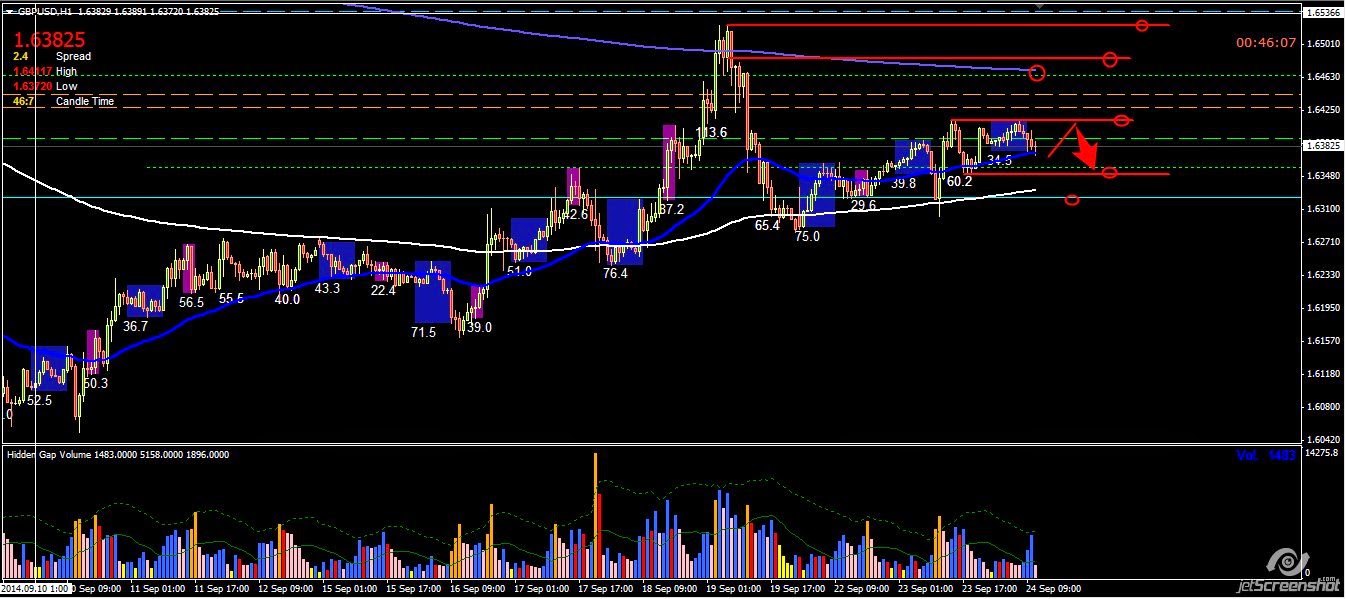

GU Analysis

GU: The daily candle is a normal spread (112pips) bull hammer closing on low vol>1day. The candle close and volume suggests a lack of buying pressure. Demand: Weekly/Daily: 1.5870, 1.5850 Short term: 1.6350, 1.6320, 1.6248, 1.6058 Supply: Short term: 1.6620, 1.6185, 1.6230 (Gap), 1.6320 (Gap close) Supply Short Term: 1.6415, 1.6475, 1.6505, 1.6550, 1.6585, 1.6600, 1.6622 Even though SM pushed prices to 1.6415 yesterday, the potential order levels are still unclear although SM has been continuing to fade weak shorts as expected. Possibly we can only be sure of their intent when they trap long breakouts at the pivot 1.6523 (I made an error yesterday) However they could reverse downward once they have sufficient orders. SM is likely to continue to retest yesterday's high of 1.6415 or higher before reversing to resume the downtrend to test the current 1.6050 low.

GU long levels: 1.6350, 1.6320, 1.6242, 1.6050, 1.5870

GU short levels: 1.6415, 1.6475, 1.6505,1.6550, 1.6585, 1.6600, 1.6622

Posted at 04.18 am EST

No comments:

Post a Comment