EU Analysis:

Levels of interest: Demand: Daily/Weekly: 1.1376, 1.0762

Background: The Euro remains weak. The coming Greek election this weekend may prove significant. Any long position is counter-trend and "corrective" as the technical trend is still down.

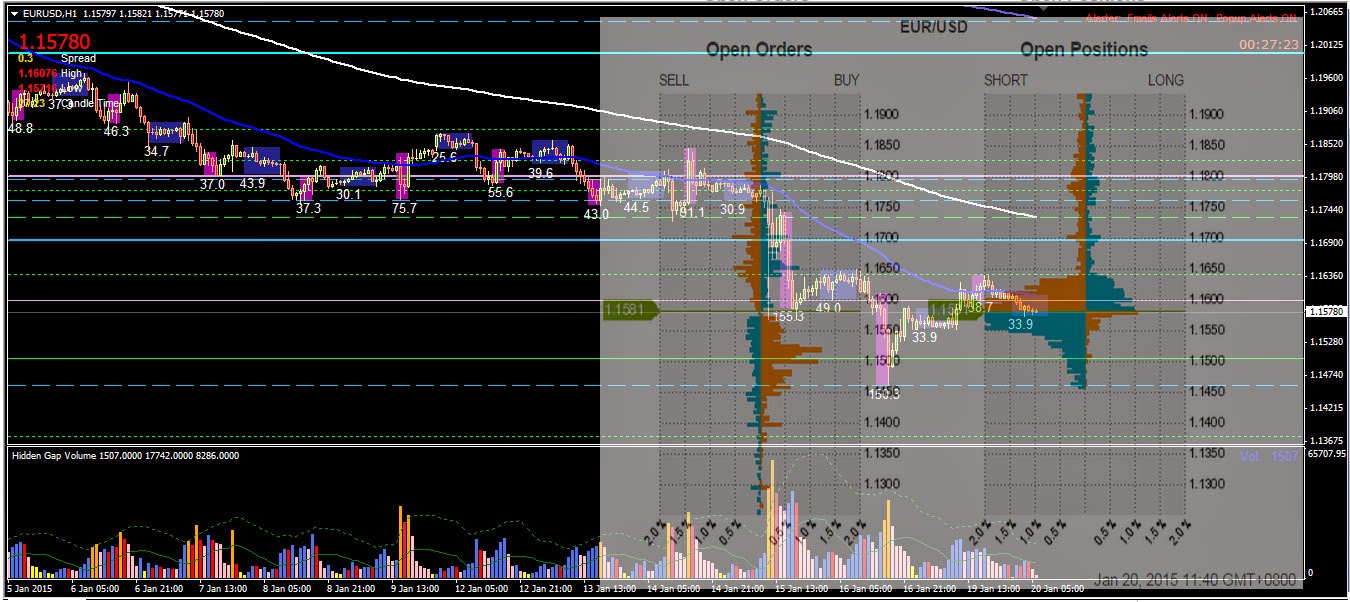

Prices yesterday was pretty much an "inside day" of last Friday. The next significant possible demand level is weekly level at 1.1376 and after that, 1.0762 Based on the Oanda order book, trapped shorts exist from 1.1581 with possible stops at 1.1640, 1.1650-60. Possible fresh "demand" can be seen 1.1510-1.1520 and 1.1490-1.5000 Both the weekly and daily close suggests profit taking/buying into the down move. SM is likely to continue creating buying pressure to around the 1.1647 or higher before reversing to resume the downward move.

Prices yesterday was pretty much an "inside day" of last Friday. The next significant possible demand level is weekly level at 1.1376 and after that, 1.0762 Based on the Oanda order book, trapped shorts exist from 1.1581 with possible stops at 1.1640, 1.1650-60. Possible fresh "demand" can be seen 1.1510-1.1520 and 1.1490-1.5000 Both the weekly and daily close suggests profit taking/buying into the down move. SM is likely to continue creating buying pressure to around the 1.1647 or higher before reversing to resume the downward move.

EU long levels: 1.1510, 1.1490, 1.1458, 1.0762

EU short levels: 1.1650, 1.1722, 1.1790, 1.1850GU Analysis:

GU: Day- The candle is a below-average spread (71pips) bear closing at the low on high vol<2days. The candle close and volume suggests more downside.

Demand: Weekly/Daily: 1.4870 - 1.4812, 1.4229 Supply: Short term: 1.5400, 1.5470, 1.5500, 1.5540, 1.5600

Background: The potential UK leadership continuity issues with forthcoming elections and the poor economic performance continue to weigh heavily on the GBP. Furthermore, it is also undermined by the SNB decision.

As expected since yesterday, price has drifted lower and from the Oanda order book, there are possible short stops located around 1.5270, 1.5300 and possible long stops from around 1.5000 - 1.5030 There are no significant supply order stacks but possibly some at 1.5400 and 1.5500 SM is likely to create selling pressure to the 1.5100 level or lower before reversing for a "corrective" move upward.

GU long levels: 1.5100, 1.5030, 1.5000, 1.4938, 1.4870, 1.4812

Posted at 1.50 am EST

No comments:

Post a Comment