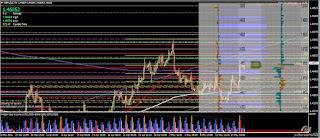

EU Analysis:

MONTH- The candle is a low spread (250pips) bull hammer closing on low vol<19months. The candle close and volume suggests more upside.

WEEK- The candle is a below average spread (163pips) bear closing near the low on low vol<6weeks. The candle close suggests more downside.

DAY- The candle is an above average spread (102pips) bear closing at the low on low vol>2days. The candle close and volume suggests more downside.

Background: Mixed US data with better business inventories and retail sales being stymied by employment and lower than expected PPI demand. After a steady discounting earlier, SM takes profit (in my opinion) and USD "strengthens" again when in fact, nothing has changed, there is no deadline for the FED's next rate hike, there is no new magic from Draghi.

Oanda order book: There trapped short volumes but very thin.

The hawkish FOMC position suggesting a rate hike for June is really nothing new. It must be said that this is still "provided that data supports it". As it were, there was already significant discounting of EU price prior to the FOMC minutes release. SM is likely to continue to push out as many weak shorts as possible to the 1.1260 level or higher before reversing.

EU short levels: 1.1265, 1.1291, 1.1311, 1.1345, 1.1386, 1.1397-1.1420, 1.1452, 1.1485-1.1491, 1.1500-1.1510, 1.1520-1.1525, 1.1532, 1.1580, 1.16001.1615, 1.1619-1.1630, 1.1711

Potential demand stacks: 1.1153-1.1140

Potential supply stacks: not applicable

Potential long (trapped) stops: 1.1311-1.1290

Potential short (trapped) stops: not applicable

Potential short (trapped) stops: not applicable

The hawkish FOMC position suggesting a rate hike for June is really nothing new. It must be said that this is still "provided that data supports it". As it were, there was already significant discounting of EU price prior to the FOMC minutes release. SM is likely to continue to push out as many weak shorts as possible to the 1.1260 level or higher before reversing.

EU long levels: 1.1200, 1.1185, 1.1170, 1.1150

GU Analysis:

MONTH- The candle is an above average spread (665pips) bull hammer closing on low vol<2months. The candle close and volume suggests more upside.

WEEK- The candle is a below average spread (190pips) bear "upthrust" closing on low vol<6weeks. The candle close suggests more downside.

DAY- The candle is a large spread (230pips) bull large-body spinning top closing on high vol>9days. Th candle close and volume suggests more upside.

DAY- The candle is a large spread (230pips) bull large-body spinning top closing on high vol>9days. Th candle close and volume suggests more upside.

Demand: Weekly/Daily: 1.3705-1.3500 Supply: Short term: 1.5574, 1.5600, 1.5619

The Oanda order book: Volumes are thin but overall trapped short volumes are still in play.

Potential demand stacks: not significantPotential supply stacks: not significant

Potential long (trapped) stops: 1.4555-1.4527

Potential short (trapped) stops: 1.4595-1.4650, 1.4757-1.4805The UK Core Retail Sales data is out soon, depending on the news, SM may whipsaw down before going back up or take weak shorts out before diving. SM is likely to fade weak shorts to the 1.4670 level or higher before reversing.

GU long levels: 1.4520, 1.4400, 1.4385, 1.4340-1.4330, 1.4310, 1.4300

Posted at 4.20 am EST

No comments:

Post a Comment