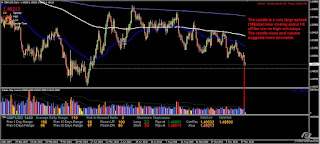

EU Analysis:

MONTH- The candle is a below average spread (492pips) bear closing at the low on low vol<13 months. The candle close suggests more downside.

WEEK- The candle is a below average spread (123pips) bear closing slightly off the low on low vol<4weeks. The candle close and volume suggests reduced selling pressure.

DAY- The candle is a normal spread (83pips) bear hammer closing on average vol>4days. The candle close and volume suggests buying.

Background: Euro has remained under pressure with a US rate rise still on the table for December. Post NDP, price has gone below the previous 1.0800 potential demand level and headed to retest the April pivot 1.0518

The Oanda order book shows newly trapped short position volumes.

With more Euro and US data due later, SM is likely to induce shorts at the day low around the 1.0550 level before taking it back up to retest the 1.0600 level and reverse to continue down.

EU short levels: 1.0600, 1.0630, 1.0670, 1.0710, 1.0725-1.0731, 1.0791

Potential demand stacks: no significant stacks

Potential supply stacks: no significant stacks

Potential long (trapped) stops: 1.0556-1.0540, 1.0492-1.0476

Potential short (trapped) stops: 1.0653-1.0662, 1.0683-1.0714

Potential short (trapped) stops: 1.0653-1.0662, 1.0683-1.0714

With more Euro and US data due later, SM is likely to induce shorts at the day low around the 1.0550 level before taking it back up to retest the 1.0600 level and reverse to continue down.

EU long levels: 1.0550

GU Analysis:

MONTH- The candle is a below average spread (503pips) bear closing just off the low on low vol<1month. The candle close and volume suggests more downside.

WEEK- The candle is a below average spread (167pips) bear closing at the low on low vol<2weeks. The candle close and volume suggests more downside.

DAY- The candle is a very large spread (189pips) bear closing about 1/6 off the low on high vol>4days. The candle close and volume suggests more downside.

DAY- The candle is a very large spread (189pips) bear closing about 1/6 off the low on high vol>4days. The candle close and volume suggests more downside.

Demand: Weekly/Daily: 1.4870 - 1.4812, 1.4229 Supply: Short term: 1.5574, 1.5600, 1.5619

The Oanda order book shows profitable and old trapped shorts with about a 100 pips range between them.

Potential demand stacks: Not significantPotential supply stacks: Not significant

Potential long (trapped) stops: 1.4918-1.4905, 1.4888-1.4871, 1.4839-1.4825

Potential short (trapped) stops: 1.4949-1.4962, 1.5021-1.5034, 1.5122-1.5164

There was good UK data today that enabled SM to fade weak shorts. SM is likely to fade weak shorts up to around the 1.5000 key level or higher before reversing.

GU long levels: 1.5025, 1.4900

Posted at 5.12 am EST

No comments:

Post a Comment