Dear friends,

If you follow this blog, you'll have noticed that I've not been posting everyday. September 2015 was only an increase of slightly over 10% equity for me as I have not taken many trades for personal reasons and I expect this month to be the same. I will post every Monday and as often as time permits. To ensure that you are updated each time that I post, I would encourage you to follow me on twitter @vseowth or my facebook page VSAnalytiks.

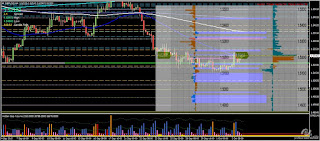

EU Analysis:

MONTH- The candle is a small spread (372pips) bear closing 1/4 off the low on low vol<1month. The candle close and volume suggests no selling pressure.

WEEK- The candle is a below average spread (183pips) bull closing on low vol>3weeks. The candle close and volume suggests selling absorption.

DAY- The candle is a very large spread (169pips) bull upthrust closing on high vol>22days. The candle close and volume suggests more downside.

Background: Last Friday's NFP data coupled with the recent dovish FOMC meeting makes for a less than appealing Dollar long bias despite talks of an impending rate hike this year continuing to weigh heavily. It is likely that prices will retest the previous monthly pivot breakout level of 1.1640 or higher as short stops to 1.1711 have largely been cleared out and it will take firm fundamental policy change such as an interest rate decision such as a USD rate hike to push EURUSD all the way back down again, that is not likely till the next FOMC meeting 27-28 Oct, a great opportunity for SM to build short positions prior to the expected tightening.

The Oanda order book shows more trapped short position volumes.

Potential Fresh demand: 1.1201-1.1188, 1.1100-1.1080, 1.0960-1.0940, 1.1027-1.1018

Potential fresh supply: 1.1300-1.1322

Long (stop) orders: 1.1193-1.1187, 1.1146-1.1138 (low volumes) 1.1080-1.1050, 1.1007-1.0980

Short (stop) orders: 1.1260-1.1265 (low volumes)

Price opened with a small gap up. SM has faded weak longs after the NFP release and are likely to maintain selling pressure to test the 1.1200 or lower before reversing.

Potential Fresh demand: 1.1201-1.1188, 1.1100-1.1080, 1.0960-1.0940, 1.1027-1.1018

Potential fresh supply: 1.1300-1.1322

Long (stop) orders: 1.1193-1.1187, 1.1146-1.1138 (low volumes) 1.1080-1.1050, 1.1007-1.0980

Short (stop) orders: 1.1260-1.1265 (low volumes)

Price opened with a small gap up. SM has faded weak longs after the NFP release and are likely to maintain selling pressure to test the 1.1200 or lower before reversing.

EU long levels: 1.1200-1.1198, 1.1185-1.1175, 1.1150, 1.1135, 1.1104, 1.1038, 1.1016, 1.0976, 1.0957

EU short levels: 1.1262-1.1272, 1.1285, 1.1317, 1.1355, 1.1394, 1.1450, 1.1530-1.1546, 1.1570, 1.1620-1.1627 GU Analysis:

MONTH- The candle is a below average spread (551pips) bear closing near the low on low vol<12months. The candle close and volume suggests no selling pressure. The candle close suggests more downside.

WEEK- The candle is a small spread (133pips) doji closing on low vol<58weeks. The candle close and volume suggests no selling pressure.

DAY- The candle is a normal spread (112pips) bull closing 1/2 below the high on average vol>4days. The candle close and volume suggests more upside.

DAY- The candle is a normal spread (112pips) bull closing 1/2 below the high on average vol>4days. The candle close and volume suggests more upside.

Demand: Weekly/Daily: 1.4870 - 1.4812, 1.4229 Supply: Short term: 1.5574, 1.5600, 1.5619

The Oanda order book shows very thin volume with more long trapped positions.

Potential demand stacks: no significant stacksPotential supply stacks: 1.5295-1.5320, 1.5493-1.5510

Potential long (trapped) stops: 1.5204-1.5195, 1.5170-1.5156, 1.5140-1.5126, 1.5102-1.5056, 1.4969-1.4919

Potential short (trapped) stops: 1.5240-1.5251, 1.5323-1.5334, 1.550-1.5365, 1.5440-1.1560Price opened with a small gap up and keeps moving upward. SM has effectively faded weak longs and now going for short stops. SM is likely to maintain buying pressure to 1.5250 or higher before reversing.

GU long levels: 1.5127

Posted at 03.00 am EST

No comments:

Post a Comment