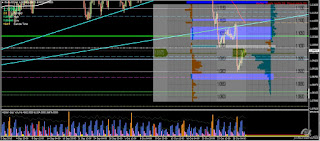

EU Analysis:

MONTH- The candle is a small spread (372pips) bear closing 1/4 off the low on low vol<1month. The candle close and volume suggests no selling pressure.

WEEK- The candle is a large spread (390pips) bear closing just off the low on low vol>1week. The candle close and volume suggests more downside.

DAY- The candle is a below average spread (83 pips) bull closing at the high on high vol<1day. The candle close and volume suggests more upside.

Background: The last NFP data coupled with the recent dovish FOMC meeting makes for a less than appealing Dollar long bias. Then last week we had Mario Draghi's butcher's knife applied to the Euro. Structurally, it is still likely that prices will retest the previous monthly pivot breakout level of 1.1640 or higher as short stops to 1.1711 have largely been cleared out and it will take firm fundamental policy change such as an interest rate decision such as a clear FED policy on USD rate hike implementation to push EURUSD to the magical parity level. Yesterday, the FED's position is that they are "ready to hike" interest rates in December. This is the policy decision that together with a dovish ECB will likely push EU to the parity level.

The Oanda order book shows more net trapped short position volumes.

Potential short (trapped) stops: 1.0994-1.1102, 1.1026-1.1075, 1.1098-1.1106

EU short levels: 1.0950-1.100, 1.0970-1.0985, 1.0992-1.1000, 1.1024-1.1038, 1.1066-1.1076

Potential demand stacks: 1.0900-1.0890

Potential supply stacks: 1.1088-1.1095, 1.1138-1.1150, 1.1193-1.1204, 1.1292-1.1302

Potential long (trapped) stops: 1.0890-1.0870

SM continued a strong fade upwards on the back of poor US data release yesterday. SM is likely to continue to fade weak shorts to the 1.1000 key level or higher before reversing. Funny, price just broke through the 1.1000 as I write.....

EU long levels: 1.0900, 1.0877-1.0861, 1.0820-1.0807

GU Analysis:

MONTH- The candle is a below average spread (551pips) bear closing near the low on low vol<12months. The candle close and volume suggests no selling pressure. The candle close suggests more downside.

WEEK- The candle is a below average spread (204pips) bear closing at the low on low vol<61weeks. The candle close suggests more downside.

DAY- The candle is a below average spread (79pips) bull closing near the high on high vol<1day. The candle close and volume suggests more upside.

DAY- The candle is a below average spread (79pips) bull closing near the high on high vol<1day. The candle close and volume suggests more upside.

Demand: Weekly/Daily: 1.4870 - 1.4812, 1.4229 Supply: Short term: 1.5574, 1.5600, 1.5619

The Oanda order book shows thin volume with significantly more trapped short positions.

Potential demand stacks: 1.5213-1.5192, 1.5123-1.5106Potential supply stacks: 1.5435-1.5450

Potential long (trapped) stops: 1.5247-1.5230, 1.5158-1.5138, 1.5107-1.5090

Potential short (trapped) stops: 1.5344-1.5365, 1.5400-1.5410, 1.5490-1.5515, 1.5535-1.5570, 1.5580-1.5592SM is likely to retest the current day high 1.5357 or higher before reversing.

GU long levels: 1.5247-1.5231, 1.5200-1.5195

Posted at 3.08 am EST

No comments:

Post a Comment