Have been super busy this week folks so I'll get everyone up to speed.

EU Analysis:

EU: The Daily candle is a below average spread (72pips) bear narrow body "near spinning top" closing on average vol>2days. The candle close and volume suggests more downside. Levels of interest: Demand: Daily/Weekly: 1.3330, 1.3300, 1.3292, 1.3250, 1.3205 Supply: short-term: 1.3382, 1.3395, 1.3410, 1.3425, 1.3440, 1.3485, 1.3500 Weekly/Daily: 1.4184, 1.4246 pivot. Even with the poor US data yesterday, prices retraced practically all the gains. SM is likely to create buying pressure to to around the 1.3382 or higher before reversing back down to test the 1.3300 key levelor lower.

EU long levels: 1.3330, 1.3292, 1.3250, 1.3205

EU short levels: 1.3382, 1.3395, 1.3410, 1.3425, 1.3440

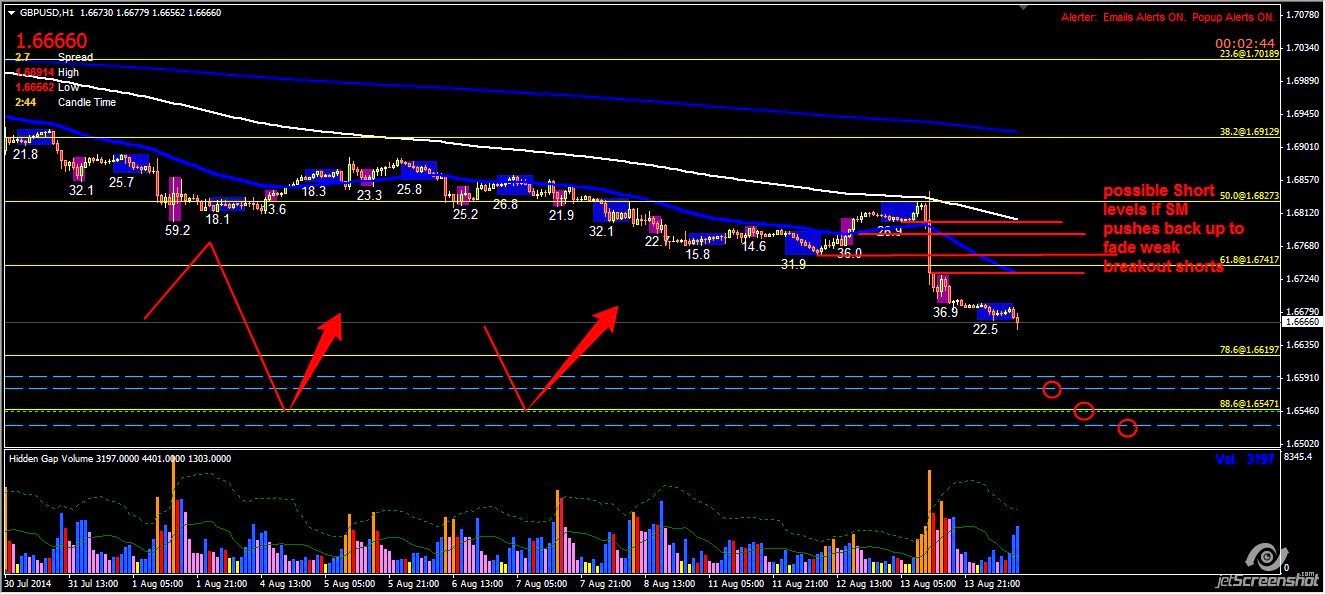

GU Analysis:

GU: The Daily candle is a very large spread (158pips) bear closing at low on very high vol>2days. The candle close and volume suggests more downside. Levels of interest: Supply short-term- 1.6735, 1.6755, 1.6803, 1.6825 Weekly/Daily supply level: 1.7178 (current pivot high), 1.7365, 1.7910, 1.800 Demand: short-term- 1.6575, 1.6546, 1.6528, 1.6480, 1.6463 The UK data released was mixed but Carney's speech gave SM the fuel to spike up to take stops and then push down as the possibility of interest rates rise became indeterminable and also expected to have a slow rate of rise, the double whammy caused a sell-off in the Cable and since yesterday has broken the prior weekly pivot. The closest order stacks now will be lower toward the next weekly pivot or lower so we can expect SM to keep pushing downwards. Any possibility of following the downward move will only materialize if SM fades weak breakout shorts, see the charts posted for possible levels. The demand levels are possible reversal levels but are yet to be confirmed until tested.

GU long levels: 1.6575, 1.6546, 1.6528, 1.6480, 1.6463

GU short levels: 1.6735, 1.6755, 1.6803, 1.6825

Posted at 03.07 am EST, updated 04.06 am EST

No comments:

Post a Comment