EU Analysis:

MONTH- The candle is an above average spread (515pips) bear closing about 1/4 off the low on average vol>2months. The candle close and volume suggests absorption of selling.

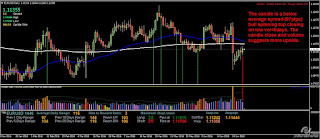

WEEK- The candle is a below average spread (198pips) bull closing near the high on high vol<1week. The candle close and volume suggests more upside.

DAY- The candle is a below average spread (97pips) bull spinning top closing on low vol<6days. The candle close and volume suggests more upside.

Background: The Brexit vote threw markets into a tailspin. Market positioning will take this into account including the FED's expected rate hikes. Bearing this in mind, the latest 5-10 year inflation expectation was reduced from 2.5% to 2.3% is even more reason to expect that the FED should hold off any further rate hikes for the time being. Overall USD strength/weakness now in the wake of the pro-Brexit poll is likely to be transient until significant US data show clear improvement. Market sentiment in the meantime supports risk aversion and safety regardless of any pending rate hike by the FED.

Oanda order book: Trapped short volumes are significant but stops remain quite far away.

EU short levels: 1.1170, 1.1190, 1.1270, 1.1314, 1.1366-1.1373, 1.1391, 1.1422, 1.1452, 1.1485-1.1491, 1.1500-1.1510, 1.1520-1.1525, 1.1532, 1.1580, 1.1600, 1.1615, 1.1619-1.1630, 1.1711

There are no planned major data releases today for the US or Euro. SM is likely to fade weak shorts to Friday's high 1.1169 or higher before reversing. I believe that the likely volume build action will be to test the highs as mentioned, reverse back to 1.070 or lower to reaccumulate and go long back towards Pre-Brexit levels, which is not inconceivable.

EU long levels: 1.1070, 1.1033, 1.1023, 1.0965, 1.0938, 1.0911

GU Analysis:

MONTH- The candle is an ultralarge spread (1897 pips) bear closing near the low on historical ultrahigh vol. The candle close and volume suggests more downside.

WEEK- The candle is a below average spread (413pips) closing on high vol<2weeks. The candle close and volume suggests more downside.

DAY- The candle is a small spread (104pips) bear spinning top closing on low vol<6days. The candle close and volume suggests more downside.

DAY- The candle is a small spread (104pips) bear spinning top closing on low vol<6days. The candle close and volume suggests more downside.

Demand: Weekly/Daily: not applicable after 31 year low was broken through. Supply: Short term: 1.5574, 1.5600, 1.5619

The Oanda order book: Volumes are too thin to have any significance.

UK Construction PMI later today will likely result in a whipsaw. SM is likely to fade weak the weak shorts to around the 1.3330 level or higher before reversing.

GU long levels: 1.3205, 1.3120 (no real demand levels as these levels are lower than the last 31 years)

Posted at 02.14 am EST

No comments:

Post a Comment