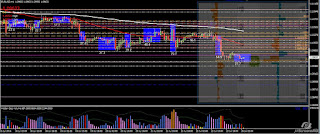

EU Analysis:

MONTH- The candle is an above average spread (515pips) bear closing about 1/4 off the low on average vol>2months. The candle close and volume suggests absorption of selling.

WEEK- The candle is a below average spread (149pips) bear closing near the low on low vol<5weeks. The candle close suggests more downside.

DAY- The candle is a near average spread (80pips) bear closing off the low on low vol<1day. The candle close and volume suggests more downside.

Background: The G20 summit was very much focused on the ramifications caused by Brexit. Even though hawkish FED members insist that rate hikes are still forthcoming, there is more reason to expect that the FED should hold off any rate hikes for the time being. Ongoing political factors such as the failed coup in Turkey and terrorism in France and Germany are significant developments that support risk aversion and safety regardless of any pending rate hike by the FED.

Oanda order book: Newly profitable short volumes up to 1.1020 with very think volumes.

With no major data releases today, SM is likely to fade weak shorts to 1.1020 or higher before reversing.

EU short levels: 1.1011, 1.1024, 1.1031-1.1040, 1.1065-1.1084, 1.1100, 1.1120, 1.1160-1.1165, 1.1190, 1.1270, 1.1314, 1.1366-1.1373, 1.1391, 1.1422, 1.1452, 1.1485-1.1491, 1.1500-1.1510, 1.1520-1.1525, 1.1532, 1.1580, 1.1600, 1.1615, 1.1619-1.1630, 1.1711With no major data releases today, SM is likely to fade weak shorts to 1.1020 or higher before reversing.

EU long levels: 1.0950, 1.0938, 1.0911

GU Analysis:

MONTH- The candle is an ultralarge spread (1897 pips) bear closing near the low on historical ultrahigh vol. The candle close and volume suggests more downside.

WEEK- The candle is an above average spread (630pips) bear spinning top closing on high vol<5weeks. The candle close and volume suggests selling absorption (in light of the poor UK data).

DAY- The candle is a small spread (119pips) bear closing near the low on low vol<1day. The candle close and volume suggests more downside.

DAY- The candle is a small spread (119pips) bear closing near the low on low vol<1day. The candle close and volume suggests more downside.

Demand: Weekly/Daily: not applicable after 31 year low was broken through. Supply: Short term: 1.5574, 1.5600, 1.5619

The Oanda order book: The volumes are very thin with no significant trapped positions.

Price opened gapped up about 45pips as SM fades weak shorts. There is no clear level for a long, look for price levels to go short. Without any UK data releases today, SM is likely to stay within Friday's range.

GU long levels: no levels

Posted at 10.32 pm EST

No comments:

Post a Comment