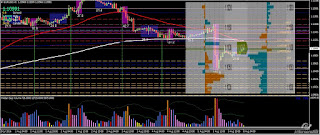

EU Analysis:

MONTH- The candle is a below average spread (245pips) bull closing near the high on low vol<1month. The candle close suggests more upside.

WEEK- The candle is a below average spread (187pips) bear large body spinning top closing on low vol<30weeks. The candle close suggests more downside.

DAY- The candle is an above average spread (115pips) bear large body spinning top closing on low vol>1day. The candle close and volume suggests more downside.

Background: FED members still insist that rate hikes are still forthcoming and last week's NFP may strengthen that intent but it will likely be limited to one more for the year in light of the ongoing geo-political and uncertainty for the world economy post-Brexit. The ongoing purge in Turkey and terrorism in France and Germany are risk aversion and safety regardless of any pending rate hike by the FED.

Oanda order book: The trapped short positions are more significant with newly profitable shorts from 1.1135

There is no major Euro or US data release today. SM is likely to fade weak shorts to 1.1150 or higher before reversing.

EU short levels: 1.1155, 1.1175, 1.1190, 1.1200, 1.1270, 1.1314, 1.1366-1.1373, 1.1391, 1.1422, 1.1452, 1.1485-1.1491, 1.1500-1.1510, 1.1520-1.1525, 1.1532, 1.1580, 1.1600, 1.1615, 1.1619-1.1630, 1.1711There is no major Euro or US data release today. SM is likely to fade weak shorts to 1.1150 or higher before reversing.

EU long levels: 1.1050, 1.0950, 1.0938, 1.0911

GU Analysis:

MONTH- The candle is a below average spread (685pips) bear "spring" closing on very high vol<1month. The candle close and volume suggests absorption of selling.

WEEK- The candle is a below average spread (350pips) bear closing near the low on low vol<9weeks. The candle close suggests more downside.

DAY- The candle is an average spread (153pips) bear spinning top closing on low vol<3days. The candle close and volume suggests more downside.

DAY- The candle is an average spread (153pips) bear spinning top closing on low vol<3days. The candle close and volume suggests more downside.

Demand: Weekly/Daily: not applicable after 31 year low was broken through. Supply: Short term: 1.5574, 1.5600, 1.5619

The Oanda order book: Volumes are very thin with trapped shorts slightly more significant.

Expect whipsawing price action to continue and steer clear if fainthearted. We continue to prefer to look for short positions after price retracements.

GU long levels: no long levels

Posted at 11.43 pm EST

No comments:

Post a Comment